July 18, 2025

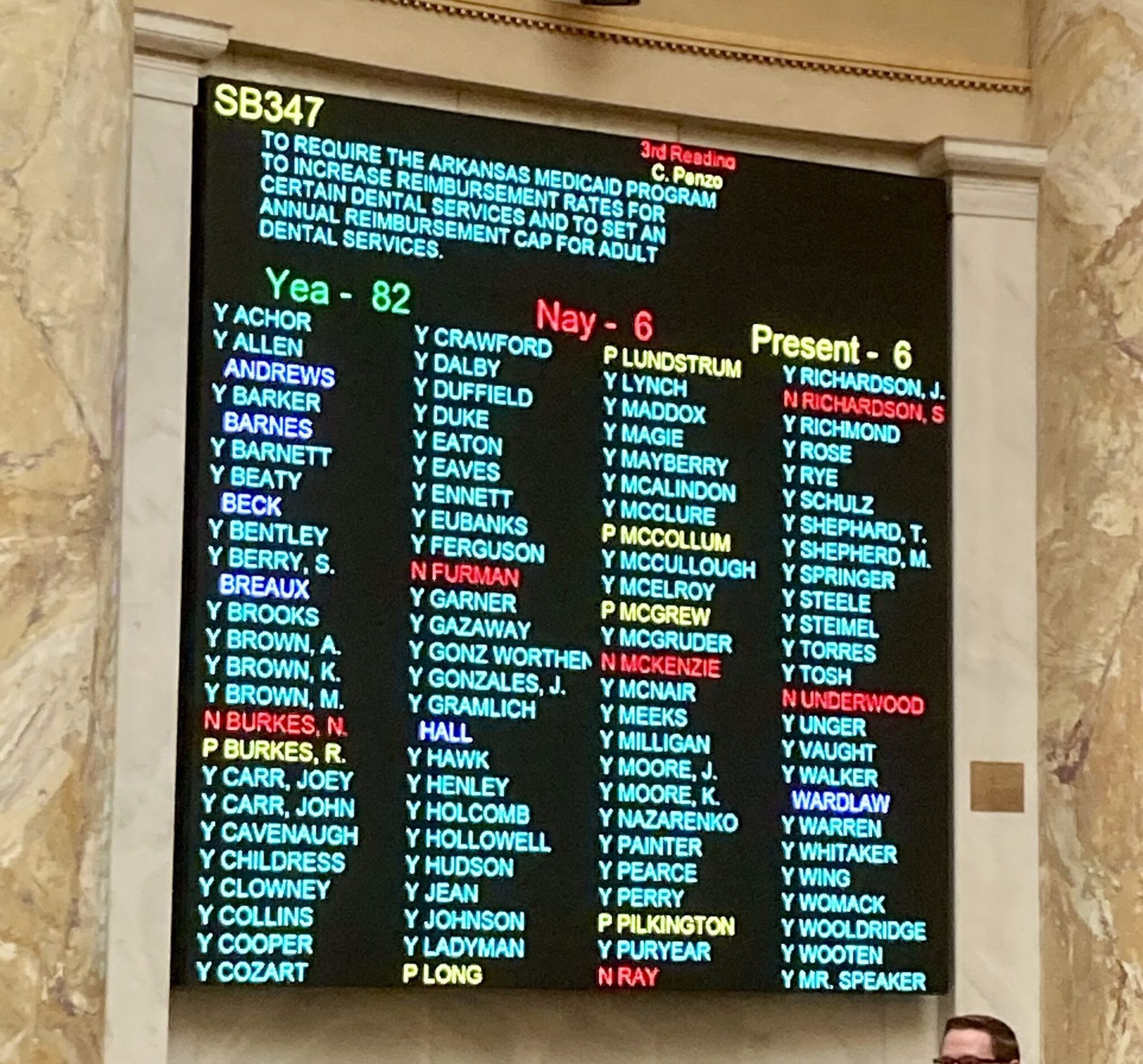

The effectiveness of organized dentistry was abundantly apparent as SB347 finally passed the House of Representatives by a vote of 82-6! And the addition of the Governor’s signature on April 22 was the icing on the cake. We appreciate the good work of Rep. Julie Mayberry, Sen. Clint Penzo and the legislative leadership for shepherding this important legislation through the process! As you may have heard before, “Everything in life is about relationships.” Now that the 95th General Assembly has adjourned, it’s important to know that may, many relationships were at the core of the passage of SB347. Without those relationships, this would not have happened. To that end, ASDA encourages its members to develop a relationship with their House and Senate representatives. The 95 th Arkansas General Assembly is in recess until next week, but it has not adjourned sine die. Although this session will be remembered as one of the most frenetic sessions in recent memory, the result for dentistry in Arkansas was very, very positive. Below is a recap of the bills that ASDA worked during the session. SB347 –Sen. Penzo, Rep. Mayberry – Act 1025 TO REQUIRE THE ARKANSAS MEDICAID PROGRAM TO INCREASE REIMBURSEMENT RATES FOR CERTAIN DENTAL SERVICES AND TO SET AN ANNUAL REIMBURSEMENT CAP FOR ADULT DENTAL SERVICES. – As the centerpiece legislation for ASDA, SB347 was hard fought and much needed to salvage a declining Medicaid dental program. Thanks to the involvement of Arkansas dentists and specialists, the bill passed the Senate 29-4 and the House 82-6. It injects $6.9 million into the Medicaid program as a match to draw down an additional estimated $16 million in federal funding for a total impact of about $23 million. The increased fee schedule is scheduled to take effect September 1, 2025. KUDOS to Dr. Terry Fiddler who has fought the battle with DHS for the past 8 months to bring this much needed fee increase to fruition!. Although it was not ASDA’s initial intent to file legislation for the increase, it became necessary to cast more light on the 18-year old fee schedule and the danger of losing providers. SB111 – Sen. Hammer -Act 395 TO ESTABLISH THE DENTIST AND DENTAL HYGIENIST COMPACT – In a measure promoted by the US Department of Defense and endorsed by the ADA, the DDS/RDH Compact will allow for licensure portability among licensed dentists and hygienists who can practice in other states without securing local licensure, but only in states that participate in the Compact. Providers who violate the practice act in any participating state will be disciplined in the state where the infraction occurred, and stand to lose privileges in all states. HB1241 Rep. Mayberry, Rep. Johnson, Sen. Irvin Act 568 TO ENSURE THAT THE ARKANSAS MEDICAID PROGRAM REIMBURSES FOR DENTAL AND ANESTHESIA COSTS FOR HIGH COMPLEXITY ORAL HEALTH CARE. This act requires that Medicaid pay for dental treatment and anesthesia for high complexity adults provided the services are rendered either at UAMS or the Lyon College School of Dental Medicine. UAMS has expressed interest in restoring these services, and the LCSODM plans to construct four operatories to treat this segment of Arkansas’ population. HB1636 – Rep. Ray et al TO AMEND THE ARKANSAS SOFT DRINK TAX ACT, AS AFFIRMED BY REFERRED ACT 1 OF 1994; AND TO PHASE OUT THE SOFT DRINK TAX BASED ON SALES TAX COLLECTIONS FROM SALES OF SOFT DRINKS. Proponents of the bill stated that the tax puts soft drink manufacturers, grocery stores and retail establishments at a competitive disadvantage especially in border cities, whereas opponents of the measure state that the tax provides a solid base for the Medicaid Trust Fund in lieu of state general revenue. Although the bill aimed to replace the tax revenue with another source of funding, that source was not identified. Without the tax, Medicaid stands to lose about $130 million in funding. The bill carried a $42.5M fiscal impact and was referred as an Interim Study Proposal to be examined prior to the next legislative session. FLUORIDATION BILLS: No fluoridation bills passed during the session. As in previous years, the effort to overturn the Community Water Fluoridation Act of 2011 was either voted down or was not brought to a vote. SB2 –Sen. Penzo, Sen. King, Rep. Duffield, Rep. Pilkington TO REPEAL THE STATEWIDE FLUORIDATION PROGRAM; AND TO REMOVE THE MANDATE FOR WATER SYSTEMS TO MAINTAIN A FLUORIDE CONTENT. This bill, which would have overturned the Community Water Fluoridation Act of 2011, originally failed in House Public Health Committee but was resurrected on the Senate floor and passed in the last 2 weeks of the session. The bill passed the full Senate, but was defeated in the House Public Health Committee. SB4 – Sen. Penzo, Sen. King, Rep. Duffield, Rep. Pilkington TO AMEND THE LAW CONCERNING PUBLIC WATER SYSTEMS; AND TO ALLOW VOTERS TO ELECT “FOR” OR “AGAINST” WATER FLUORIDATION. This bill expired in Senate State Agencies Committee. SB468 – Sen. Penzo, Sen. King, Rep. Duffield, Rep. Pilkington TO AMEND THE LAW CONCERNING FLUORIDATION OF A PUBLIC WATER SYSTEM; AND TO ALLOWS VOTERS TO ELECT “FOR” OR “AGAINST” WATER FLUORIDATION IN THE COUNTY. This bill would have provided a path for water systems to sponsor a vote on whether to fluoridate the local water supply. It passed Senate State Agencies Committee, but failed in the Senate by a vote of 9-17. SB474 – Sen. Penzo, Sen. King, Rep. Duffield, Rep. Pilkington TO AMEND THE LAW CONCERNING PUBLIC WATER SYSTEMS; AND TO ALLOW THE BOARD OF A PUBLIC WATER SYSTEM TO PROHIBIT FLUORIDATION OF THE WATER IN THE PUBLIC WATER SYSTEM. This bill expired in Senate Public Health Committee. SB613 – Sen. Penzo, Sen. King, Rep. Duffield, Rep. Pilkington TO CREATE AN ELECTION PROCEDURE TO DETERMINE FLUORIDATION OF A PUBLIC WATER SYSTEM. This bill, which was the preferred option for local voting on community water fluoridation, passed the Senate State Agencies committee, the full Senate and the House State Agencies committee, but expired on House of Representatives agenda.